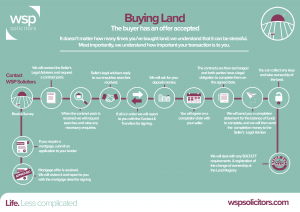

Top tips: Our guide to buying land

If you are considering buying some land, but you are unsure of the process of the transaction we have a step-by-step guide to the process.

At WSP Solicitors, we like to make life less complicated and have prepared a 10-step guide to the commercial conveyancing process.

Step 1: Obtaining a mortgage

If you are obtaining a mortgage for the purchase, you will need to submit your application to the Lenders. The Lender may book a survey for the Property.

At this point, you should instruct your Solicitors in respect of the purchase.

We will require full details of the terms agreed upon for the purchase.

If agents are involved, they will provide a copy of the heads of terms.

Step 2: Terms of business

We will arrange for a file to be opened and our terms of business to be issued. We will then require these to be completed, signed and returned together with certified copies of your photographic ID and payment on account of cost.

We make initial contact with the Sellers Solicitors in respect of the purchase and request the contract pack from them.

Step 3: Requesting searches

When the contract pack is received, we will request searches. The most common searches are the: Local Authority Search, Water and Drainage Search and Environmental Search.

If you are obtaining a mortgage, your lender will require full searches on the Land.

We will review the draft papers, title documents and replies to enquiries received from the Seller together with the search results upon receipt. A copy of the documents will be provided to you for your review and comments.

We will raise any necessary enquiries and request further information from the Seller’s Solicitor if required.

Step 4: Source of funds

Once the contract and transfer are agreed upon and all replies to our enquiries and necessary documents have been received.

At this stage, we will request a source of funds from you. We will require information on how the purchase monies have been accrued and corresponding documents. (If you are purchasing with a mortgage, we will require information on how the deposit monies have been accrued)

We will report you on the title and provide you with the engrossments Contract and Transfer for signature and return. We will advise you on the signing of the documents.

Step 5: Completion date

Upon receipt of the source of funds documents, we will request the deposit monies from you.

We will agree on a completion date with the Seller’s Solicitor and will notify the Lender of the agreed completion date (If you are obtaining a mortgage).

Step 6: Exchange contacts

We will obtain your authority to exchange contracts and will thereafter contact the Seller’s Solicitor to do the exchange.

Once contacts have been exchanged, both parties have a legal obligation to complete on the agreed completion date.

At this stage, you will be obligated to purchase the land.

Step 7: Completion Statement

A Completion Statement for the balance of funds will be sent to you. We will require the balance of the purchase funds to be transferred to us in readiness for completion.

If you are purchasing with a mortgage, we will await the funds from the Lender. These will be received in readiness for completion.

Step 8: Take ownership of the land

On the day of completion, we will request your authority to complete and funds will be sent to the Sellers Solicitor.

Upon receipt of the funds, the seller’s Solicitor will contact us to complete. We will notify you once completion has taken place.

At this stage, if there are keys to the land these can be collected by you, normally from the agents or directly from the Seller.

Step 9: SDLT/LTT

Following completion, we will arrange for the SDLT/LLT return to be submitted (if required) and will submit our Land Registry application.

Step 10: Final Steps

Once the Land Registry has completed the application, we will send a copy of the updated title to you for your records.

WSP Solicitors have a specialist and experienced Commercial Property Team who have helped many clients buy or sell agricultural land. To get in touch for help or more information you can use the web form here. Alternatively you can call us on 01453 847200.